Mortgage Protection

Home Sweet Home

Protect your Most Important asset!

Your Home

Protect What Matters Most

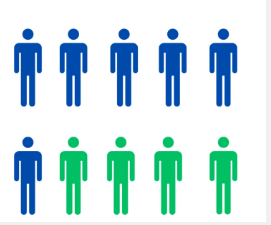

3 out of 10 people have problems paying their medical bills and deductibles.

6 out of 10 people with health insurance used up all or most of their savings for medical bills.

The consequences don’t have to be.

Join the millions who worry less, breathe easier and experience life with a Life Insurance policy with Living Benefits.

Death Benefit

A tax-free reservoir of funds that can help provide lifestyle continuity to your family and loved ones.

Living Benefits

Access the death benefit with a qualifying terminal, chronic or critical illiness or injury.

Cash Value

Builds in the policy and potentially grows tax-deferred.

Your home is so much

more than a house

Your home is where you build your life, your memories. It’s the place where meals are shared, scrapes are bandaged and bedtime stories are read. You’ve worked hard to create a home for you and your family. But if something were to happen to you, how long could your family pay the mortgage?

Protect your home, protect your lifestyle

Term life insurance can be a simple and affordable option to help protect your investment. That’s because it canprovide a tax-free fixed death benefit that can be used to pay for anything you choose — including your mortgage.

Term life insurance from our carries puts you in control with flexible coverage options designed to help meet your needs today and tomorrow.

How life insurance can protect your mortgage.

Make the Decision Today

The right life insurance coverage can help protect you and your loved ones on life’s path.

Talk with your agent today to find out how to get started.